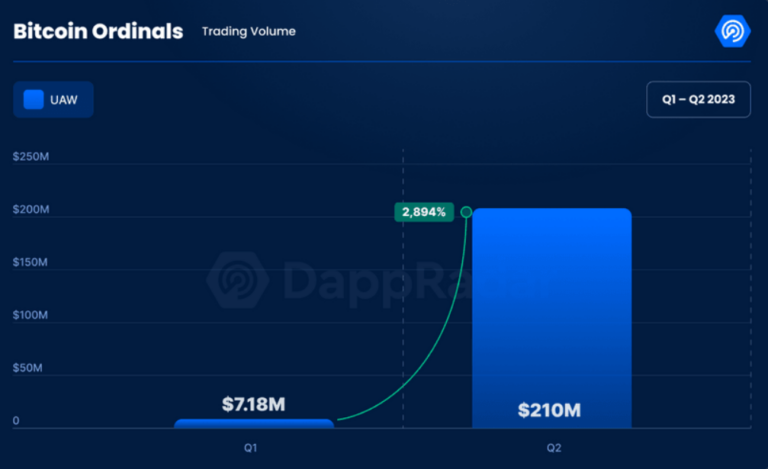

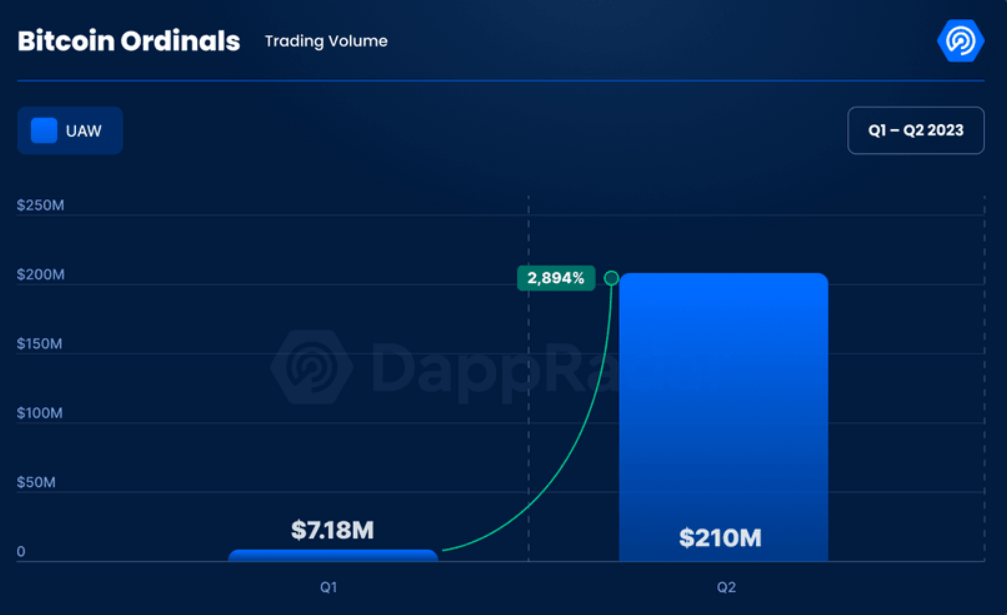

In the fast-paced world of cryptocurrency, Bitcoin has consistently remained at the forefront, capturing the attention of investors and enthusiasts alike. The second quarter of 2023 witnessed a significant uptrend in Bitcoin Ordinals, resulting in a massive surge in trading volume. This article delves into the reasons behind this uptrend, explores the implications for the cryptocurrency market, and analyzes the factors contributing to the increase in trading volume.

The Uptrend of Bitcoin Ordinals

Bitcoin Ordinals, also known as Bitcoin’s ordinal values, refer to the ordinal position of a specific Bitcoin transaction in the blockchain. These ordinal values play a crucial role in determining the chronological order of transactions, ensuring the security and integrity of the Bitcoin network.

During the second quarter of 2023, Bitcoin Ordinals experienced a remarkable uptrend. This uptrend can be attributed to several key factors:

1. Growing Institutional Adoption

One significant driver behind the uptrend of Bitcoin Ordinals is the growing institutional adoption of Bitcoin. Major financial institutions, including banks and investment firms, have recognized the potential of Bitcoin as a store of value and have started incorporating it into their investment portfolios. This institutional interest has fueled a surge in demand, driving up the price of Bitcoin and subsequently increasing the trading volume.

2. Increased Retail Participation

Apart from institutional adoption, the second quarter of 2023 witnessed a significant increase in retail participation in the cryptocurrency market. Retail investors, driven by the potential for substantial returns, flocked to Bitcoin and other cryptocurrencies. This influx of retail investors led to a surge in trading volume, as more individuals sought to capitalize on the uptrend of Bitcoin Ordinals.

3. Positive Market Sentiment

Market sentiment plays a vital role in the performance of cryptocurrencies. During Q2 of 2023, the overall sentiment surrounding Bitcoin was largely positive. Several positive developments, such as regulatory clarity in some jurisdictions, increased mainstream media coverage, and the growing acceptance of cryptocurrencies as a legitimate asset class, contributed to a bullish outlook on Bitcoin. This positive sentiment encouraged more investors to enter the market, further driving up the trading volume.

Implications for the Cryptocurrency Market

The uptrend of Bitcoin Ordinals and the subsequent increase in trading volume in Q2 of 2023 have significant implications for the cryptocurrency market as a whole:

1. Improved Liquidity

With a surge in trading volume, the liquidity of Bitcoin and other cryptocurrencies improves. Increased liquidity enhances market efficiency, enabling traders to execute their orders quickly and at desired prices. Moreover, improved liquidity can attract more institutional investors, as they require sufficient liquidity to enter and exit large positions. The uptrend of Bitcoin Ordinals, therefore, contributes to the overall maturation and stability of the cryptocurrency market.

2. Price Volatility

While the increase in trading volume signifies growing interest and participation, it also brings along increased price volatility. Higher trading volume amplifies price fluctuations, as a larger number of market participants execute trades. Traders and investors must carefully navigate this volatility and employ risk management strategies to mitigate potential losses.

3. Regulatory Scrutiny

As Bitcoin and other cryptocurrencies gain more prominence, regulatory scrutiny also intensifies. Governments and regulatory bodies worldwide are closely monitoring the cryptocurrency market to ensure investor protection, prevent money laundering, and maintain financial stability. The surge in trading volume during Q2 of 2023 may attract additional attention from regulators, potentially leading to the implementation of new regulations or modifications to existing ones.

Factors Contributing to the Increase in Trading Volume

Several factors contributed to the massive increase in trading volume during the second quarter of 2023:

1. Halving of Bitcoin Rewards

Bitcoin’s scheduled halving event, which occurred in 2020, reduced the block reward for miners by half. This reduction in supply, combined with increasing demand, creates a scarcity of Bitcoin, driving up its price and subsequently increasing trading volume.

2. Technical Developments

Continuous technical developments in the Bitcoin ecosystem have contributed to the increase in trading volume. Upgrades to the underlying blockchain technology, such as the implementation of the Lightning Network for faster and cheaper transactions, have attracted more users to the network. These advancements enhance the overall user experience and increase confidence in Bitcoin as a viable digital currency.

3. Global Economic Uncertainty

Uncertainty in the global economy often prompts investors to seek alternative assets, such as Bitcoin, to hedge against traditional market risks. The economic uncertainties during Q2 of 2023, such as inflation concerns, geopolitical tensions, and the aftermath of the COVID-19 pandemic, may have driven more investors towards Bitcoin, thereby increasing trading volume.

Conclusion

The uptrend of Bitcoin Ordinals during Q2 of 2023 brought about a massive increase in trading volume, propelled by growing institutional adoption, increased retail participation, and positive market sentiment. This surge in trading volume has implications for the cryptocurrency market, improving liquidity, introducing price volatility, and inviting regulatory scrutiny. Factors such as Bitcoin’s halving event, technical developments, and global economic uncertainties have played a significant role in driving the increase in trading volume.

As the cryptocurrency market continues to evolve, it is essential for investors to stay informed, monitor market trends, and exercise caution while navigating the exciting yet volatile world of Bitcoin and other cryptocurrencies. The uptrend of Bitcoin Ordinals in Q2 of 2023 serves as a testament to the growing interest and potential of cryptocurrencies as they continue to shape the future of finance.