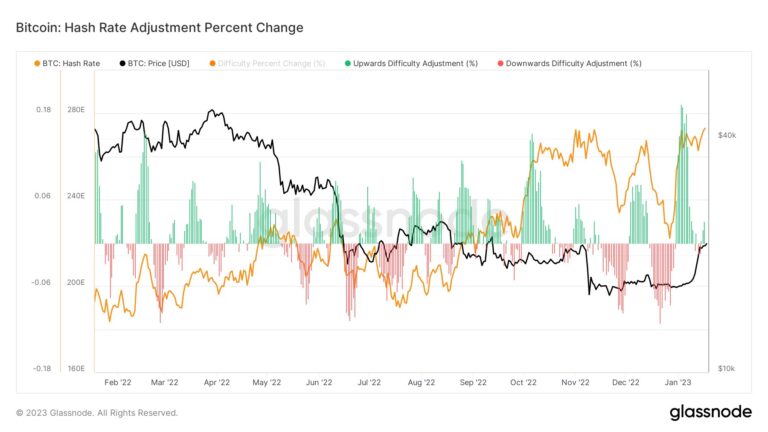

Cryptocurrency enthusiasts witnessed a remarkable event on December 25th, 2023, as Bitcoin hash rates surged by an astounding 130%, reaching an unprecedented peak above 540 EH/s. This surge marked a significant milestone for the leading cryptocurrency, highlighting the ever-growing interest and investment in the blockchain network. However, amidst the celebration of this remarkable achievement, a parallel narrative unfolded — miner profitability experienced an unexpected decline.

Understanding the Surge: Unraveling the Factors Behind the 130% Increase

The surge in Bitcoin hash rates can be attributed to several key factors that collectively contributed to this momentous rise. One pivotal element is the continuous advancements in mining hardware and technologies. As mining rigs become more sophisticated and efficient, miners can process transactions at an unprecedented speed, thereby increasing the overall hash rate of the Bitcoin network.

Additionally, the growing interest of institutional investors in the cryptocurrency space has fueled increased mining activity. Large-scale mining operations backed by significant financial resources have entered the arena, deploying cutting-edge equipment to capitalize on the potential rewards offered by Bitcoin mining. This influx of institutional capital has undoubtedly played a pivotal role in propelling the hash rates to new heights.

The Culmination on Christmas Day: 540 EH/s Achieved

December 25th, 2023, will be etched in the annals of Bitcoin history as the day the network achieved a hash rate exceeding 540 EH/s. This remarkable feat underscores the resilience and scalability of the Bitcoin blockchain. The decentralized nature of the network, coupled with the continuous commitment of miners worldwide, has enabled Bitcoin to reach this impressive milestone.

In 2023, Bitcoin hash rates surged by 130%, reaching a new peak above 540 EH/s on December 25th. However, miner profitability experienced a decline as the network faced unforeseen challenges.

The Flip Side: Miner Profitability Takes a Hit

While the surge in hash rates brought euphoria to the crypto community, it was not without its challenges. Miner profitability, a critical metric for the sustainability of the mining ecosystem, experienced an unexpected decline. Several factors contributed to this downturn, prompting miners to reassess their strategies and adapt to the evolving landscape.

1. Increased Competition

The influx of new miners, driven by the allure of Bitcoin’s surging value, intensified competition within the network. With more participants vying for block rewards, individual miners found their share of the pie diminishing. This heightened competition put pressure on profit margins, causing a ripple effect throughout the mining community.

2. Rising Energy Costs

Bitcoin mining is an energy-intensive process, and the surge in hash rates coincided with an increase in energy costs. As miners expanded their operations to capitalize on the bullish market, the associated rise in electricity expenses eroded profit margins. Striking a balance between profitability and sustainability became an intricate dance for miners in 2023.

3. Market Volatility

The cryptocurrency market, known for its inherent volatility, played a role in the decline of miner profitability. Fluctuations in the price of Bitcoin directly impact the value of rewards received by miners. Sudden market downturns can significantly diminish the returns on mining investments, posing challenges to the financial viability of mining operations.

Adapting to Change: Strategies for Sustaining Profitability

In the face of declining profitability, miners were compelled to reassess their strategies and adopt innovative approaches to remain competitive in the ever-evolving landscape of Bitcoin mining.

1. Optimal Hardware Utilization

Miners explored the utilization of the latest mining hardware that offered improved efficiency and performance. Upgrading to more energy-efficient rigs became a crucial strategy to mitigate rising energy costs and maximize profitability.

2. Diversification of Mining Pools

Diversifying mining activities across multiple pools emerged as a risk mitigation strategy. By spreading their hashing power, miners aimed to reduce the impact of potential fluctuations in any single mining pool, thereby enhancing overall stability and profitability.

3. Long-Term Vision and HODLing

Some miners adopted a long-term vision, choosing to accumulate Bitcoin and strategically HODL (Hold On for Dear Life) during periods of lower profitability. This approach involved weathering short-term challenges with the expectation of future price appreciation, aligning with the ethos of many steadfast cryptocurrency believers.

The Road Ahead: Navigating Challenges in a Dynamic Landscape

In 2023, Bitcoin hash rates surged by 130%, reaching a new peak above 540 EH/s on December 25th. However, miner profitability experienced a decline, serving as a reminder of the dynamic nature of the cryptocurrency ecosystem. As the industry continues to evolve, miners will undoubtedly face new challenges and opportunities, requiring adaptability and resilience to navigate the ever-changing terrain of Bitcoin mining.

In conclusion, the surge in hash rates represents a monumental achievement for Bitcoin, showcasing its robustness and attractiveness to miners globally. Simultaneously, the challenges faced by miners underscore the need for continuous innovation and strategic adaptation in the pursuit of sustained profitability within the cryptocurrency mining landscape. In 2023, the world witnessed the simultaneous rise of hash rates and the recalibration of miner strategies, shaping the future trajectory of Bitcoin and its mining community.