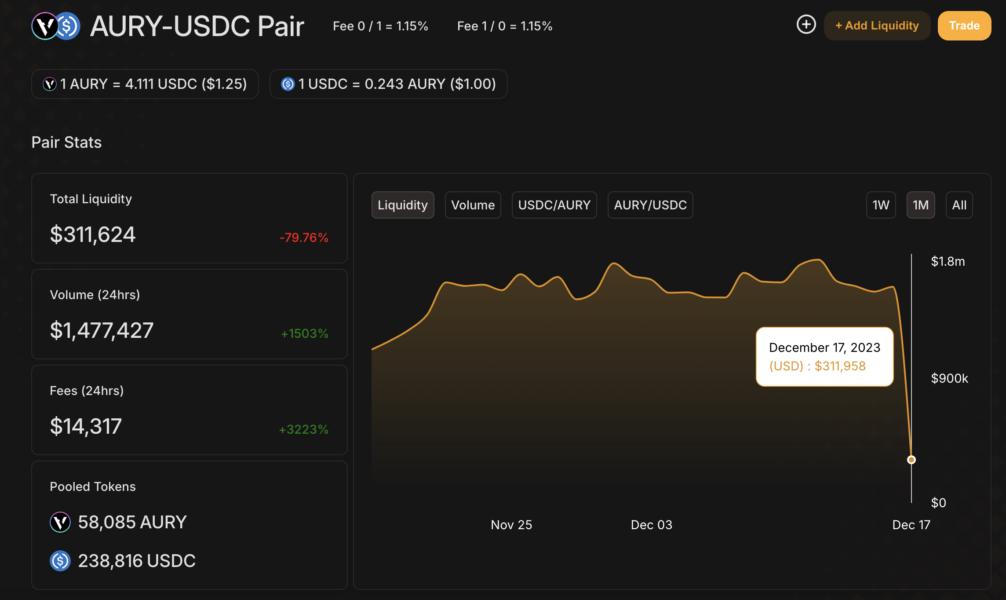

Cryptocurrency enthusiasts and traders were left in shock as the AURY-USDC pool faced a significant setback on Arbitrum’s decentralized exchange (DEX) Camelot. The repercussions were profound, resulting in an 80% reduction in liquidity. This unexpected turn of events has sent ripples through the crypto community, raising questions about the security and stability of decentralized finance (DeFi) platforms.

Understanding the AURY-USDC Pool Drainage

In the heart of the decentralized financial ecosystem, Camelot on Arbitrum had been a beacon of trust and innovation. The AURY-USDC pool, a vital component of Camelot’s liquidity, recently experienced an unprecedented drainage. This unfortunate incident has left traders and liquidity providers grappling with the aftermath.

The Mechanics Behind the Drainage

To comprehend the gravity of the situation, it’s crucial to delve into the mechanics of the AURY-USDC pool drainage. Arbitrum, a layer 2 scaling solution for Ethereum, has been lauded for its efficiency in processing transactions. However, vulnerabilities within the smart contracts governing the AURY-USDC pool were exploited, leading to a drain that shook the very foundations of Camelot.

Unmasking the Culprits

The identity of those behind the drainage remains shrouded in mystery. The decentralized nature of blockchain technology often makes it challenging to pinpoint the perpetrators. Was it a flaw in the smart contract code, or did a group of malicious actors exploit a vulnerability for financial gain?

Examining the Smart Contract Code

Security experts are meticulously scrutinizing the AURY-USDC pool’s smart contract code to identify potential loopholes. This incident underscores the critical importance of rigorous code audits and continuous monitoring to ensure the robustness of DeFi protocols.

The Hunt for Perpetrators

Blockchain forensics teams are on the trail, attempting to trace the movement of funds from the drained pool. The anonymity afforded by cryptocurrencies makes this task particularly challenging, but the crypto community remains resilient in its pursuit of justice.

Impact on Liquidity Providers

Liquidity providers, a crucial element of the DeFi ecosystem, bore the brunt of the AURY-USDC pool drainage. An 80% reduction in liquidity translates to significant losses for those who had entrusted their assets to the Camelot platform. The incident has sparked a broader conversation about the risks associated with providing liquidity in the volatile world of decentralized finance.

Repercussions for Traders

Traders utilizing the AURY-USDC pool on Camelot now face increased slippage and decreased trading opportunities. The sudden reduction in liquidity can result in higher transaction costs, affecting the overall user experience on the platform.

The Road to Recovery

In the wake of this crisis, the Camelot team is working tirelessly to restore confidence in the platform. Measures such as compensation for affected users and enhanced security protocols are being implemented to prevent future incidents. The incident has also prompted a broader conversation within the crypto community about the need for standardized security practices in the development and deployment of DeFi protocols.

Strengthening Security Measures

Camelot is collaborating with cybersecurity experts to fortify its smart contracts and address any vulnerabilities that may exist within its infrastructure. The goal is to create a more resilient and secure platform for users, mitigating the risks associated with potential exploits.

Rebuilding Trust

Rebuilding trust within the community is a challenging but essential task for Camelot. Transparent communication, regular updates, and proactive steps to address the aftermath of the drainage are crucial in assuring users that the platform is committed to their security and financial well-being.

The AURY-USDC Pool: A Cautionary Tale

The AURY-USDC pool drainage on Arbitrum’s DEX Camelot serves as a cautionary tale for the broader DeFi landscape. As the industry continues to evolve, the need for robust security measures, thorough audits, and community vigilance becomes increasingly evident.

Learning from the Incident

The crypto community must collectively learn from the AURY-USDC pool drainage, leveraging it as an opportunity to enhance the security standards of decentralized finance platforms. Open dialogue, collaboration, and shared knowledge are crucial in building a more resilient and trustworthy ecosystem.

Conclusion

In the ever-changing landscape of decentralized finance, unexpected challenges can arise, testing the mettle of platforms and the resilience of the community. The AURY-USDC pool drainage on Arbitrum’s DEX Camelot has undoubtedly left its mark, but with proactive measures and a commitment to security, the crypto community can emerge stronger, wiser, and better prepared for the challenges that lie ahead.