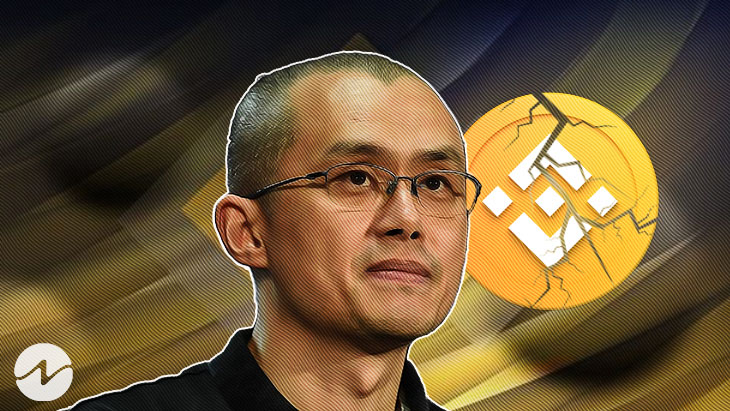

Cryptocurrencies have long been associated with a certain level of anonymity and decentralization, providing users with a sense of freedom from traditional financial institutions. However, recent developments in the crypto world have cast a shadow over this perceived freedom. Changpeng ‘CZ’ Zhao, the founder and CEO of Binance, one of the world’s largest cryptocurrency exchanges, is currently entangled in a legal battle after admitting to Anti-Money Laundering (AML) violations. This revelation has sent shockwaves through the cryptocurrency community, sparking debates about the need for more stringent regulations in the industry.

The Unraveling Legal Saga of Changpeng ‘CZ’ Zhao

Changpeng ‘CZ’ Zhao’s legal troubles began when he openly acknowledged AML violations within Binance, raising questions about the exchange’s compliance with international financial regulations. The admission came as a surprise to many, considering Binance’s prominence in the crypto space.

The potential consequences for CZ are severe, with a looming 12-18 months of imprisonment hanging over his head. This turn of events has not only put CZ in a precarious position but has also triggered an intense examination of the broader issues surrounding cryptocurrency regulation.

Cryptocurrency Regulation: A Balancing Act

The cryptocurrency market has always operated on the fringes of traditional finance, with advocates emphasizing the decentralized nature of digital currencies. However, CZ’s legal woes have brought to light the challenges that come with balancing innovation and regulation in the crypto space.

The Need for Stricter AML Measures

One of the critical issues highlighted by CZ’s case is the urgent need for stricter Anti-Money Laundering measures within the cryptocurrency industry. The decentralized and pseudonymous nature of many cryptocurrencies has made them an attractive tool for money laundering and other illicit activities. Regulators globally are now facing the challenge of crafting policies that strike a balance between preserving privacy and preventing financial crimes.

International Cooperation in Regulation

As cryptocurrencies operate on a global scale, achieving effective regulation requires international cooperation. CZ’s case underscores the importance of collaboration between regulatory bodies worldwide. The lack of a unified regulatory framework has allowed some exchanges to operate in a regulatory gray area, leading to potential abuses that harm both investors and the integrity of the financial system.

Impact on Binance and the Crypto Community

Changpeng ‘CZ’ Zhao’s legal battle has not only affected him personally but has also had a profound impact on Binance and the broader cryptocurrency community. Binance, once a symbol of innovation and success, is now grappling with reputational damage and increased scrutiny from regulators.

Binance’s Response to the Crisis

In response to the legal challenges, Binance has taken steps to address the concerns raised by regulatory authorities. The exchange has pledged to implement comprehensive AML measures and enhance its cooperation with regulatory bodies. However, the extent to which these measures can rebuild trust and mitigate the potential legal consequences remains uncertain.

Community Reactions and Investor Confidence

The cryptocurrency community, known for its passionate and vocal nature, has been quick to react to CZ’s legal troubles. Some argue that increased regulation is necessary for the long-term legitimacy and sustainability of the crypto market, while others fear that overregulation could stifle innovation and hinder the core principles of decentralization.

Investors in Binance and other cryptocurrencies are closely monitoring the situation, with the legal uncertainties contributing to a volatile market. The outcome of CZ’s legal battle may influence investor confidence not only in Binance but also in the broader crypto ecosystem.

The Road Ahead: Navigating Cryptocurrency Regulation

Changpeng ‘CZ’ Zhao’s legal hurdles serve as a wake-up call for the cryptocurrency industry. As the market continues to evolve, finding the right balance between innovation and regulation becomes increasingly crucial.

Collaborative Efforts for Regulatory Clarity

To address the critical issues highlighted by CZ’s case, industry stakeholders, including exchanges, developers, and regulators, must engage in collaborative efforts. Establishing clear and consistent regulatory guidelines will not only protect users and investors but also foster a healthier and more sustainable crypto ecosystem.

Education and Awareness

As the regulatory landscape evolves, there is a pressing need for education and awareness within the cryptocurrency community. Users, investors, and industry participants must stay informed about the changing regulatory environment to navigate the complexities and ensure compliance with the law.

Conclusion: A Pivotal Moment for Cryptocurrency Regulation

Changpeng ‘CZ’ Zhao’s legal battle serves as a pivotal moment for the cryptocurrency industry. The outcome will likely shape the future of cryptocurrency regulation, influencing how exchanges operate, and how investors engage with digital assets.

The issues highlighted by CZ’s case underscore the importance of striking a delicate balance between innovation and regulation. As the crypto community grapples with these challenges, one thing remains clear – the need for a comprehensive and globally coordinated approach to cryptocurrency regulation has never been more evident.

Changpeng ‘CZ’ Zhao is facing legal hurdles after admitting Anti-Money Laundering violations. With a potential 12-18 months imprisonment, his legal battle highlights critical issues in cryptocurrency regulation. The crypto world watches closely as the industry navigates uncharted waters, seeking a path that preserves the essence of decentralization while addressing the pressing need for regulatory clarity and accountability.