The cryptocurrency and blockchain space has witnessed remarkable growth and innovation in recent years, with non-fungible tokens (NFTs) playing a central role in this transformation. One of the prominent platforms in the NFT ecosystem is OpenSea, a marketplace for digital collectibles and unique digital assets. In a surprising move, Coatue Management, a notable hedge fund, has decided to significantly reduce its investment in OpenSea by 90%, decreasing its stake from $120 million to $13 million. This article explores the reasons behind this substantial reduction and the potential implications for the NFT market and OpenSea.

Coatue Management’s Initial Investment:

Coatue Management’s initial investment in OpenSea at $120 million highlighted the growing confidence in the NFT market and its potential for disruption in the traditional art and collectibles sectors. The platform, known for its vast selection of digital art, music, and virtual real estate, was perceived as a promising avenue for future growth and innovation.

Reasons for the Reduction:

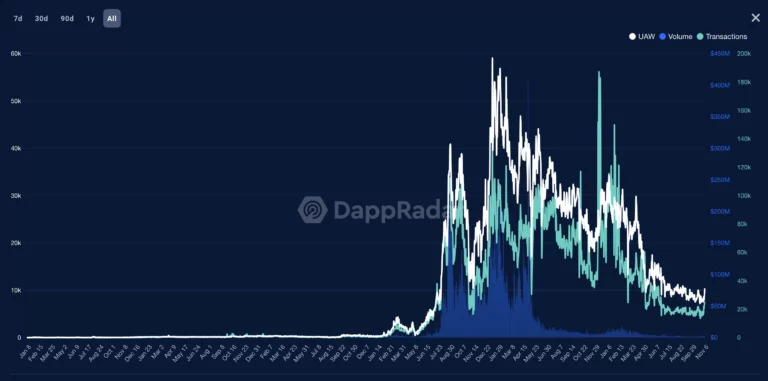

- Market Volatility: The cryptocurrency market, including NFTs, is known for its price volatility. The significant fluctuation in the value of NFT assets may have prompted Coatue Management to reconsider its investment and risk exposure.

- Regulatory Uncertainty: The NFT market has attracted the attention of regulators in various jurisdictions. Uncertainty regarding future regulatory actions might have influenced the decision to reduce the investment.

- Changing Sentiment: Investor sentiment in the cryptocurrency and NFT space can be influenced by market trends and public perception. A shift in sentiment or market dynamics might have played a role in the decision.

- Portfolio Diversification: Hedge funds often diversify their portfolios to manage risk and exposure. Reducing the investment in a single asset class or platform could be part of a broader diversification strategy.

Implications for OpenSea and the NFT Market:

- Market Perception: The significant reduction by Coatue Management could potentially impact market perception and influence other investors and funds in the NFT sector. It may lead to increased scrutiny of NFT platforms and their sustainability.

- OpenSea’s Future: OpenSea remains one of the leading NFT marketplaces, and its long-term growth prospects appear positive. However, the reduction in investment may prompt OpenSea to adapt its strategies and address any concerns raised by investors.

- Regulatory Response: Regulatory bodies may closely monitor the NFT market in response to developments like this. The reduction in investment highlights the need for clear regulatory guidelines in the NFT space.

- Investor Caution: Investors in the NFT market may exercise caution and conduct thorough due diligence before committing significant capital, considering the potential for price volatility and market dynamics.

Conclusion:

Coatue Management’s decision to reduce its investment in OpenSea by 90% is a significant development in the NFT space and the broader cryptocurrency market. While the exact reasons behind this move remain speculative, it underscores the evolving nature of the crypto and NFT sectors and the importance of risk management in the face of market volatility and regulatory uncertainties. As the NFT market continues to evolve, it is likely to face increased scrutiny and adapt to changing investor sentiment and financial dynamics.